Financial Modelling for Startups

Stefan Dangubic | Financial Modelling

10. November 2023

Topics

- What fundamental assumptions are crucial for creating a robust financial model?

- How do investors use the results of a financial model for their decision-making?

- How do you get a "bankable" financial model?

Contents

Overview

According to a study by the market research company CB Insights, 47% of start-ups fail due to inadequate financing caused by poor financial planning. Professional financial planning is one of the most important factors in correctly planning capital requirements and gaining the trust of investors.

In this article, we would like to highlight the key benefits that startups can gain from creating a professional financial plan and what they should consider when doing so. In addition, we will explain the basic principles of financial planning, describe the most important inputs of a financial model and show how investors use the results for their investment decisions.

On the one hand, the results of the financial planning serve as a basis for decision-making for investors and banks. Equity providers can assess whether the business idea is scalable and whether they can achieve the desired return on capital. Banks can estimate the amount of potential loan financing. On the other hand, the results of the financial planning are addressed to the founders themselves. Founders often have an idea that they are convinced of, but are not sure how profitable it is. Financial planning enables a structured quantification of expenditure and income and ensures that no important factors are overlooked.

A financial plan that allows you to simulate different scenarios is called a financial model. A financial model is comparable to an architectural model. As with a construction project, a business start-up should not be approached without a model.

In addition to the base case financial plan, various scenarios should be calculated. Scenarios are combinations of planning assumptions that are used to simulate the profitability of the start-up under different initial conditions. Scenarios should be used in particular for assumptions that are subject to a high degree of uncertainty. There is usually a 'base case', which is the most likely case, as well as an 'upside case' and a 'downside case'.

Typically, a financial model should cover the next 4-5 financial years. In the case of longer-term debt financing, the bank will often also want to see a plan until the loan is fully repaid.

To summarise, this article deals with the following questions:

- What fundamental assumptions are crucial for creating a robust financial model?

- How do investors use the results of a financial model for their decision-making?

- How do you get a "bankable" financial model?

What fundamental assumptions are crucial for creating a robust financial model?

The aim of this chapter is to explain the basic assumptions that need to be taken into account when creating a financial model for a start-up.

The assumptions are the most important part of any financial model and must be defined with the utmost care, as the results of the model can only be as good as the assumptions. Some assumptions are relatively easy to check, such as tax rates, depreciation rates or non-wage labour costs. Others, such as the planned sales volume, require intensive market research and are often the decisive value drivers.

Which assumptions require more attention depends heavily on the industry and cannot be generalised. While assumptions about market share are important for a wholesale company, assumptions about product development costs and development time can be crucial to the success of a technology company.

The following sections explain some of the most important assumptions that need to be taken into account in a financial model.

Sales Assumptions

In its simplest form, sales are modelled using a price-volume structure. This is based on specific price assumptions that are multiplied by the forecast sales volume. Depending on the industry, however, more complex calculations are usually required for the sales forecast.

Let's take an online subscription model as an example: The relevant quantity here is derived from the number of monthly active users. This must be calculated taking into account the monthly new customer acquisition as well as the customer attrition rate, known as the "Churn Rate". The forecast of monthly new customers can be done either through a bottom-up or a top-down approach. With the bottom-up method, the number of new customers is derived from the existing sales and marketing budget and the assumed customer acquisition cost per new customer ("Customer Acquisition Cost"). In contrast, the top-down method determines the sales and marketing costs for a given number of new customers.

Furthermore, prices cannot generally be assumed to be static, as they are subject to external influences. Examples include seasonal factors or fluctuations in commodity prices, which must be integrated into the model in order to ensure an accurate sales forecast.

Cost Assumptions

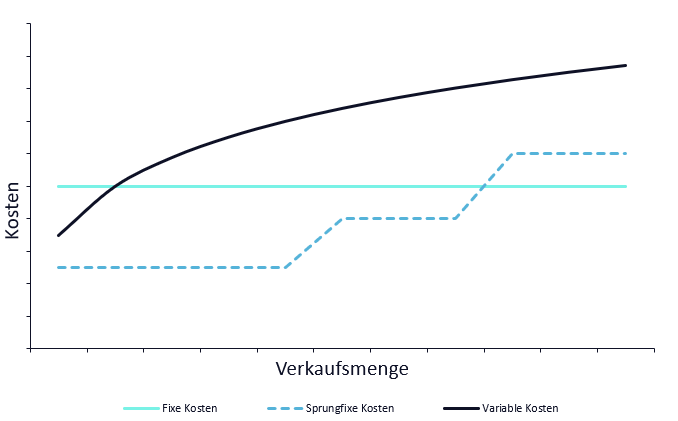

The categorization of costs by type and behavior in relation to sales volume is central to financial planning. Costs are typically categorized by type, such as material, labor, and other. They are also classified according to their relationship to sales volume. There are three major categories:

- Fixed costs: These costs remain constant, regardless of the sales volume.

- Variable costs: These costs vary in proportion to the sales volume.

- Step costs These costs remain constant up to a certain threshold value, but then rise sharply as soon as this is exceeded.

Depending on the industry and the company's business model, each cost type can be variable, fixed or a step cost. For example, it is common to treat the rental costs of an IT company as fixed costs. In retail, on the other hand, where expansion often involves opening new shops, rental costs should be considered fixed as they increase with the growth of the business and the number of shops.

In some situations, it may also be appropriate to break down an individual cost type further. For example, one part may be fixed and another variable.A good example of this is personnel costs: in the case of a courier service, the cost of drivers could be considered a variable cost because it varies with the number of deliveries, while the salaries of administrative staff are considered a fixed cost because they are incurred regardless of the volume of business.

Investment Assumptions

Investments represent the financial resources that a start-up invests in assets from which it expects to derive long-term benefits. These assets typically include property, operating equipment and technological infrastructure.

In accounting, capital expenditure is treated differently to current operating expenses. The acquisition costs for capital goods are not recognised directly as operating expenses, but are depreciated over the expected useful life. This depreciation affects the company's taxable income and therefore has an indirect impact on liquidity.

In addition to the initial investment costs, it is also crucial to include future maintenance and servicing costs in the financial planning. In sectors such as restaurant franchise, for example, it is not uncommon for a complete renovation of the interior to become necessary after a period of three to five years. These recurring expenses must be carefully planned to avoid financial bottlenecks.

Other important assumptions (working capital, inflation, scenarios and taxes)

The working capital is defined as the difference between current assets and current liabilities. Current assets include, for example, trade receivables and inventories, while current liabilities include, for example, trade payables. Working capital planning is an important part of liquidity planning and should be included in every financial model. Poor planning of working capital requirements can lead to a company receiving sufficient orders but not having enough liquidity to fulfil these orders.

Inflation plays an important role in long-term financial planning, as it influences future price trends. This should be taken into account in the financial model by integrating an assumed annual inflation rate and forming an inflation index in order to ensure realistic cost and price forecasts.

Tax modeling must consider the specific laws of the country in which the startup operates. For example, countries such as Austria and Germany allow for the use of tax loss carryforwards. These regulations should be considered in the financial model to enable an accurate prediction of tax burdens and benefits.

Last but not least, scenarios are an indispensable part of any financial model. They make it possible to run through various future scenarios and analyse the effects of changes in key variables such as sales volumes, prices and cost structures. By analysing upside-case, downside-case and base-case scenarios, companies can better prepare for uncertainties and develop appropriate strategies.

How do investors use the results of a financial model for their decision-making?

A financial model provides a number of key results that are essential for assessing the financial health and potential of an organisation. The most important results include:

- Forecasted income statement: It provides information about the expected income and expenses and thus about the future net profit of the company.

- Balance sheet: It reflects the assets and financial position and shows the capital structure of the company at a specific point in time.

- Cash flow statement: It illustrates how cash flows are generated and utilised in the company and is crucial for assessing liquidity.

The following key figures are particularly important for equity providers:

- Sales growth - derived from the income statement.

- Financing requirements - derived from balance sheet and cash flow statement.

- Internal rate of return (IRR) - derived from the cash flow.

- Industry-specific parameters (KPIs) - These key figures are geared towards the specific success factors of the respective industry.

These four key figures, which are the focus of investors, are explained in more detail below.

Sales Growth

Sales growth measures the percentage increase in a company's total sales over a certain period of time. For start-ups, robust sales growth is an important indicator of the scalability of their business model.

Start-ups generally target growth investors who pursue the growth investing approach. This approach differs from value investing, where investors look for companies that are currently undervalued. Growth investors, on the other hand, focus on companies that have the potential to achieve above-average growth in the future. Sales growth is therefore a key indicator for investors to assess the potential of a start-up. They look for indicators that the company is not only able to generate sales, but that these sales will also increase significantly in the future.

The challenge in forecasting revenue growth lies in the balance: overly optimistic estimates can undermine credibility, while overly cautious assumptions can reduce investor interest. Statistics show that successful start-ups record average growth rates of 120 % in the first year, 83 % in the second year and 60 % in the third year after investors join. However, these figures vary greatly by country and sector.

Financing Requirements

Financing is a critical factor for the success of a start-up. As already mentioned, inadequate financing often leads to the failure of young companies. A comprehensive financial model is essential to accurately determine financing requirements. In practice, start-ups that only prepare a profit and loss account without a complete balance sheet plan often misjudge their financing requirements.

Most founders start with their own funds and later draw on additional investment from business angels and venture capital companies. When deciding in favour of external financing, start-ups usually go through several rounds of financing:

Seed round: The seed phase is the first financing round, which is often supported by business angels. It serves to support the development of a prototype or an initial product and to validate the business model. The amount of seed financing varies greatly and can range from a few tens of thousands to several million euros. Detailed financial planning for the start-up is essential from this point at the latest.

Series A: Series A financing is the first significant capital raise that enables the start-up to expand its business activities, grow its team and expand its customer base. This round is usually carried out by venture capital companies and can amount to tens of millions of euros.

Series B: Series B: Series B is about accelerating the growth of the start-up and gaining market share. This round is also usually facilitated by venture capital companies and serves to scale the business.

Series C: Series C and subsequent rounds are usually used to help a start-up expand into new markets or prepare for an initial public offering (IPO).

Zoom, a provider of video conferencing software, for example, has completed nine rounds of financing totalling USD 270 million.

In view of the various financing rounds and phases a start-up may find itself in, it is important to take future financing rounds into account when drawing up the initial financial plans, as these have a significant impact on the company's growth potential.

An important aspect in determining financing requirements is planning on a monthly basis rather than on an annual basis, as is usual for companies that have been in existence for some time. Planning on an annual basis is unsuitable for start-ups, as it does not take into account the maximum financing requirements during the year.

The following figure shows an example in which the maximum financing requirement is reached in April 2025. If the start-up were to plan on an annual basis instead of a monthly basis, it would calculate a significantly lower financing requirement and therefore enter into negotiations with the investor with an incorrect amount.

IRR Expected by Investors

The internal rate of return (IRR) indicates the estimated annual return on the investment over the planning horizon and is a good indicator for comparing different investments with different cash flows. The IRR can be derived from the planned cash flows and assumptions about an exit multiple.

According to the National Bureau of Economic Research, the average return for venture capital companies is 25%. Most venture capital companies therefore expect a return of significantly more than 25% on their investments, as they also have to price in unsuccessful exits. For many early-stage start-ups, an IRR of 35% - 40% is the benchmark, while late-stage companies require an IRR of around 30% over an average period of eight years.

Industry-specific KPIs

KPI stands for Key Performance Indicator and is a quantitative measure of the industry-specific performance of start-ups. KPIs offer the opportunity to evaluate the achievement of corporate goals and compare them with the competition.

The most important KPIs for a start-up can vary depending on the industry and business model. Some commonly used KPIs are:

- Customer Acquisition Cost (CAC): The cost of acquiring a new customer, including marketing and sales costs.

- Customer Lifetime Value (CLV): The sum of the income that a customer generates for a company during their lifetime.

- Monthly Recurring Revenue (MRR): Total amount of revenue generated by subscription-based services each month.

- Churn rate: Proportion of customers lost per month in relation to the total number of existing customers.

- Conversion rate: Percentage of website visitors or potential customers who perform a desired action, e.g. make a purchase or sign up for a newsletter.

- Burn rate: The rate at which a startup uses up its cash reserves.

- Runway: The period of time that a start-up can bridge before it runs out of money.

As already explained, the KPIs differ considerably from industry to industry. In e-commerce, for example, the conversion rate is a central KPI that measures the proportion of website visitors who become buyers. For start-ups in the software-as-a-service (SaaS) sector, on the other hand, KPIs such as customer acquisition costs (CAC) and customer churn rate could take centre stage. For a retail company, the average order value (AOV) or the turnover rate could be decisive KPIs.

KPIs enable investors to compare the assumptions in business plans with the performance of other companies in the same sector. Investors, who often specialise in certain sectors, usually have a strong understanding of the extent to which the forecast KPIs of a start-up can be considered realistic.

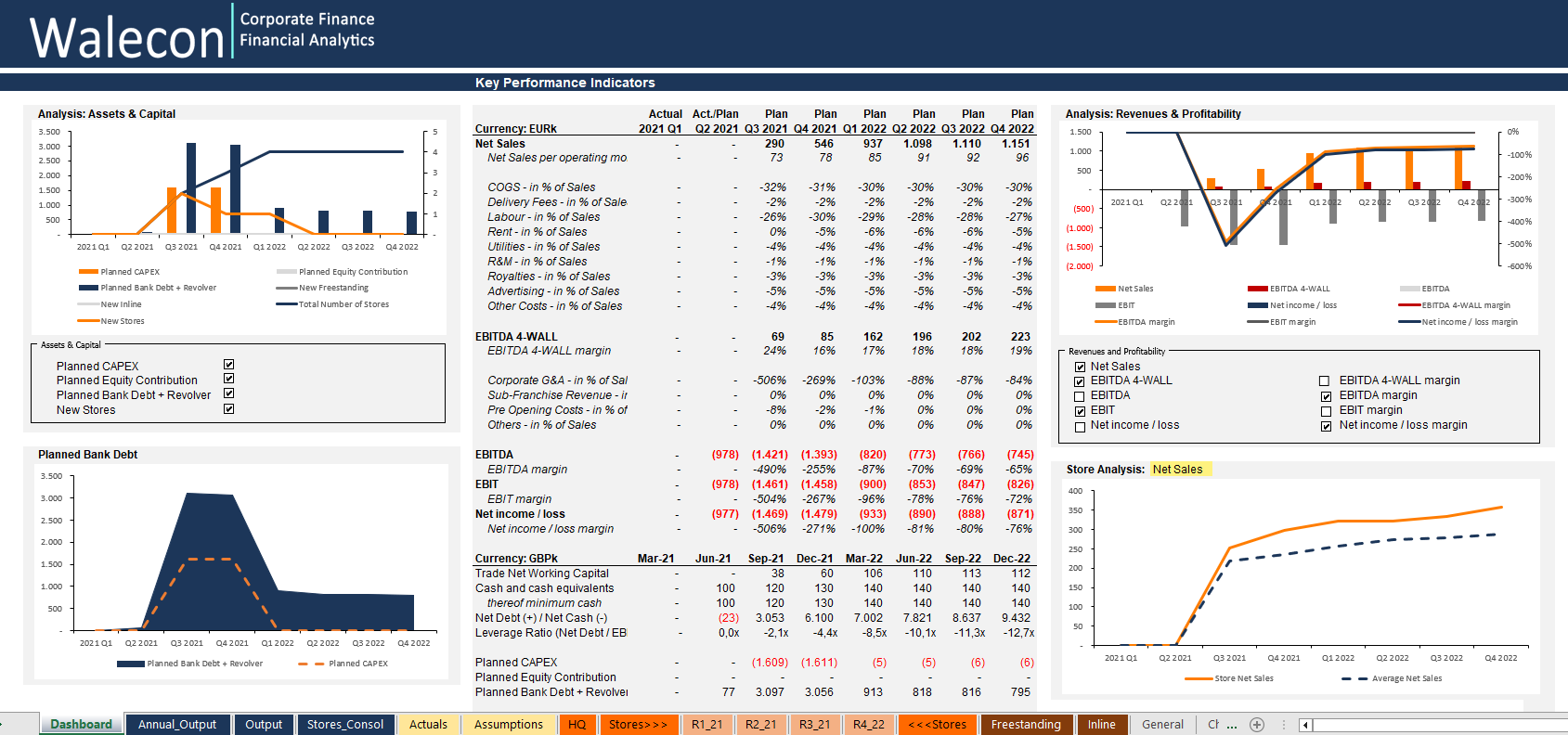

Dashboard

A financial model is not only a calculation tool, but also a communication tool. A meaningful dashboard in a financial model is therefore crucial for the successful communication of results. The results should be presented intuitively, visually appealing and professionally. Investors want a clear and concise overview of a start-up's financial performance. A well-designed dashboard can help to transparently present the underlying assumptions alongside the key financial figures. This can help to boost investor confidence and make the start-up more attractive to potential investors.

How do you get a "bankable" financial model?

The financial model should be investor ready or bankable, i.e. it should have been prepared according to best practice rules, and it should be integrated, i.e. the links between the balance sheet, income statement and cash flow must be correct.

There are various ways to create a bankable financial model for a start-up. You can use templates from the Internet. This option is inexpensive and sufficient for a simple business model. The disadvantage is that it is not optimally adapted to the specifics of the business model and does not comply with local tax and accounting regulations. Subsequent adjustments to the financial model are often very time-consuming.

Hiring a consulting firm that specialises in creating financial models is often the best way to obtain a bankable financial model that is tailored to the specific needs of the start-up. This approach saves time in the long term and is favoured by investors.

Support with financial modelling, valuation, data analytics, Excel and Power BI.

Walecon e.U.

Gentzgasse 148/1/5

1180 Vienna

Austria